As a startup, deciding whether to hire people as subcontractors or employees can be challenging. Both options have their benefits and drawbacks, so it’s important to evaluate them carefully before making any decisions. In this blog, we will breakdown what Canadian small businesses need to know when evaluating hiring people as subcontractors vs. payroll, including CRA rules and tax implications.

Subcontractors vs. Employees

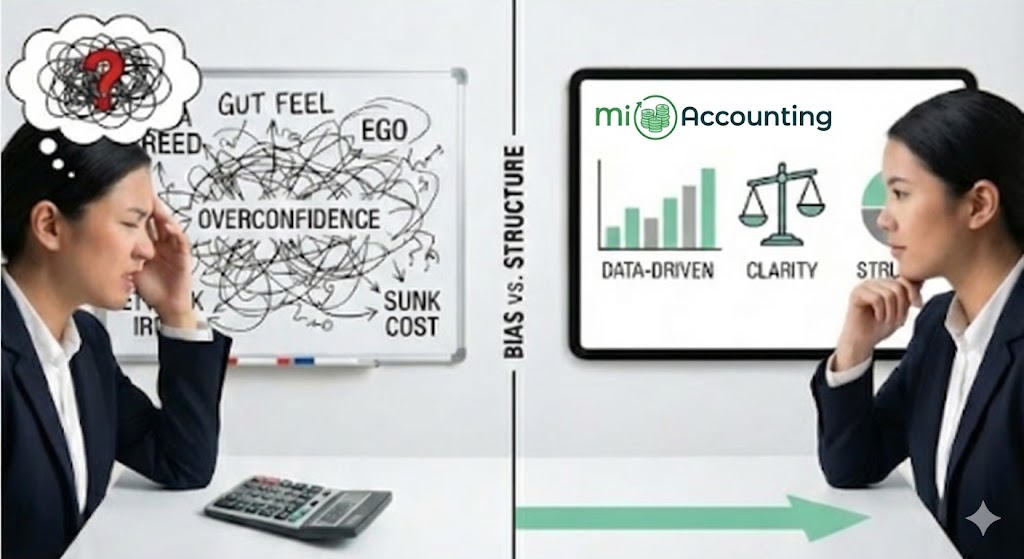

Subcontractors, also known as independent contractors, work on a project-by-project basis and are responsible for their own taxes and benefits. They typically have more control over their work than employees do. In contrast, employees are subject to the company’s rules and regulations, receive benefits, and have their taxes withheld by the company.

CRA Rules for Subcontractors

The Canada Revenue Agency (CRA) has specific rules for subcontractors. If you hire a subcontractor, you must ensure that they meet the CRA’s definition of an independent contractor. This means they must have control over their own work, have a business license or be registered with the CRA, provide their own tools and equipment, and be responsible for their own taxes and benefits. If a subcontractor does not meet these criteria, the CRA may consider them an employee, and you may be required to withhold taxes and provide benefits.

T4A and T5018 Tax Forms

When it comes to subcontractors, it’s essential to understand the T4A and T5018 tax forms. The T4A form reports payments made to subcontractors for services rendered, and the T5018 form reports payments made to subcontractors for construction services. These forms must be issued to subcontractors if you paid them more than $500 in a calendar year. It’s important to ensure that you accurately report all payments made to subcontractors on these tax forms. Failure to do so can result in penalties and fines from the CRA.

Tax Implications

There are tax implications for both subcontractors and employees. As an employer, you are responsible for withholding taxes from your employees’ paychecks and remitting those taxes to the government. You must also pay employer contributions to Employment Insurance (EI), Canada Pension Plan (CPP), and other programs. In contrast, if you hire a subcontractor, they are responsible for their own taxes, and you do not have to make employer contributions. However, if the CRA determines that a worker should have been classified as an employee, you may be required to pay back taxes and penalties.

When deciding whether to hire people as subcontractors or employees, it’s crucial to evaluate the benefits and drawbacks of each option, as well as the CRA rules and tax implications. At MiAccounting, we specialize in providing accounting and advisory services to Canadian small businesses, including payroll, tax, and compliance support. Our experienced professionals can help you make the right decision for your startup and ensure that you are in compliance with all tax and employment regulations. Contact us today to learn more about how we can help your startup succeed.